- Sustainable Development

- Letter from the Chairman

- Sustainable Highlights

- Sustainable Operation

- Corporate Governance

Task Force for Climate-related Financial Disclosures, TCFD

According to the WEF’s “Global Risk Report 2025,” “Extreme weather events” is once again listed as the highest global risk for the next decade, with half of the top 10 risks closely related to the environment, showing the need for governments and enterprises to strengthen climate governance while implementing climate actions. To comprehensively assess risks and opportunities related to climate change, SYSTEX, as a TCFD supporter, refers to the Task Force on Climate-related Financial Disclosures (TCFD) as an analysis framework.

Governance

The Chairman is the highest governance level for sustainable development, and assigns the CSO as the leader of the Sustainability Group to supervise ESG implementation and performance.

-

The Board has authorized the Chairman to act as the highest level of sustainability governance, establishing the “Sustainability Group” in 2020, and then set the CSO as the leader of the Sustainability Group in 2021 to coordinate climate risk assessment and formulate strategies, goals, and measures.

-

The Sustainability Group conducts biennial climate risk and opportunity assessments, with the Environment Team planning and executing related strategies.

-

The Sustainability Group reports progress to the Chairman as needed, and presents annual performance results along with action plans for the following year to the Board.

Strategy

Formulate the “Environment and Energy Policy” to achieve “Net Zero by 2050 at HQ” and implement risk and opportunity identification, and climate analysis.

-

The “Sustainability Group” is responsible for identifying climate risks and opportunities every 2 years. The Environment Team plans related strategies and goals, and implements relevant programs, to address the financial impact of climate-related risks and opportunities.

-

Timeframe for climate management: the short-term is within 2 years, the medium-term is 2-10 years, and the long-term is more than 10 years.

Assessment approach

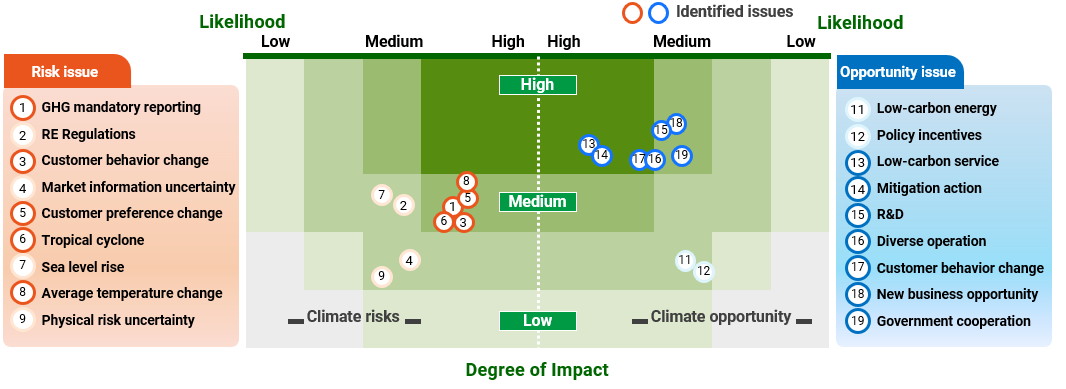

- SYSTEX collected 36 climate-related risk issues and 22 opportunity issues. Following initial relevance screening, the Group identified 9 risk and 9 opportunity items. Further assessment based on impact and likelihood led to 5 material risks and 7 opportunities, with financial impacts and management measures analyzed for each.

- [5 material risks] Include 2 physical (average temperature change, tropical cyclones) and 3 transition risk (customer preference change, GHG mandatory reporting, customer behavior change), covering physical, market, reputation, and regulatory categories.

- [7 material opportunities] Include “Low-carbon service, mitigation action, R&D, new business opportunity, customer behavior change, diverse operation, Government cooperation,” related to products, services, and markets.

Climate-related risk and opportunity matrix

Note 1: The 36 climate risk issues include 13 related to physical risks, such as “tropical cyclones, extreme temperature changes, changes in rainfall patterns and distribution, extreme rainfall and droughts, snow and ice, sea level rise, average temperature change, average rainfall change, uncertainty of physical risks, changes to the human and cultural environment, socioeconomic fluctuations, humanitarian concerns, and social uncertainty.” Additionally, there are 23 topics related to transition risks, encompassing “regulatory, legal, technological, market, and reputational dimensions. These include carbon taxes, fuel and energy taxes, cap-and-trade systems, GHG mandatory reporting, product efficiency regulations and standards, product labeling regulations and standards, renewable energy regulations, air pollution controls, uncertainty around new regulations, lack of regulation or legal compliance, international conventions and agreements, voluntary commitments, legal litigation, low-carbon service, investment in new technologies, transition to low-carbon technologies, consumer behavior change, market information uncertainty, natural resources change, fluctuations in raw material markets, customer preference change, and reputational damage.”

Note 2: The 22 climate opportunity issues span 5 key dimensions: resource efficiency, energy sources, products and services, market dynamics, and resilience. These include “transportation models, production processes, use of recycled materials, energy-efficient buildings, water resource utilization, low-carbon energy, policy incentives, adoption of new technologies, participation in carbon markets, development of localized microgrids, low-carbon service, mitigation action, R&D, diverse operation, consumer behavior change, new business opportunity, government cooperation, involvement in public infrastructure projects, funding channels expansion, participation in renewable energy programs, energy efficiency improvement, and the use of alternative or diversified resources.

Note 3: The Sustainability Group conducted the first phase of issue identification based on the relevance to the company, reviewing 36 climate risk issues and 22 climate opportunity issues. Through this process, 9 climate risk issues were selected: “GHG mandatory reporting, renewable energy regulations, customer behavior change, market information uncertainty, customer preference change, tropical cyclone, sea level rise, average temperature change, physical risk uncertainty.” Additionally, 9 climate opportunity issues were selected: “low-carbon energy, policy incentives, low-carbon service, mitigation action, R&D, diverse operation, customer behavior change, new business opportunity, government cooperation.”

Financial impact and mitigation measures of climate-related issues

| Risk topic |

Detail | Timeframe | Impact | Likelihood | Financial impact (-) | Mitigation measure | |

| Physical risk |

Average temperature change |

Rising average temperatures drive up electricity use and operating costs. | Long-term |

Medium |

Medium-High |

|

|

| Tropical cyclone |

Increasing tropical cyclone intensity may damage assets and raise maintenance costs. Governmental work suspensions, power outages, or flooding can disrupt operations. |

Mid-term |

Medium | Medium-High |

|

|

|

| Transition risk | Customer preference change |

Due to the rising awareness of global sustainability, customers’ preferences have changed. |

Mid-term |

Medium | Medium-High |

|

|

| Customer behavior change | Due to the rising awareness of global sustainability, customers have different considerations while making decisions. | Mid-term | Medium | Medium-High | |||

| GHG mandatory reporting | Companies may be compelled to inventory, report, or verify GHG emissions In line with laws and regulations. | Mid-term | Medium | Medium-High |

|

|

|

| Opp. topic | Detail | Timeframe | Impact | Likelihood | Financial impact (+) | Mitigation measure | |

| Product and Service | Low-carbon service | Actively promoting low-carbon services enhances corporate brand image. | Mid-term | Medium-High | Medium-High |

|

|

| Diverse operation | Provide more low-carbon services to stabilize market position and competitiveness. | Mid-term | Medium-High | Medium-High | |||

| Mitigation action | New products or services help to reduce or adapt to the impact of global climate change risks. | Mid-term | Medium-High | Medium-High |

|

|

|

| R&D | Adopting innovative processes or changing services can contribute to the mitigation and adaptation of climate change. | Mid-term | Medium-High | Medium |

|

|

|

| Customer behavior change | Customers have different considerations while choosing products or services. | Mid-term | Medium-High | Medium-High |

|

|

|

| Market | New business opportunity | Increase profits in existing markets, or find new business opportunities in emerging markets. | Mid-term | Medium-High | Medium |

|

|

| Government cooperation | Participate in government projects to obtain subsidies or rewards, and to gain popularity. | Mid-term | Medium-High | Medium |

|

|

|

Climate-related scenario analysis

Climate scenario analysis was conducted based on 2 physical risk topics: “average temperature change and tropical cyclone.”

| Risk topic | Scenario detail | Potential financial impact (-) | Mitigation measure | |

| Physical risk | Average temperature change |

Based on the IPCC AR6 Shared Socioeconomic Pathways (SSP)

|

|

|

| Tropical cyclone |

Based on RCP8.5 scenario from the National Science and Technology Center for Disaster Reduction

|

|

|

|

Risk Management

The Board is the highest governance level for risk management and has set up a “Risk Management Committee” to be responsible for supervising the effective operation of the risk management mechanism.

-

SYSTEX has set up a “Risk Management Committee” in 2022 and formulated “Risk Management Best Practice Principles,” “Risk Management Policies and Procedures.” It is stipulated that the Board is responsible for approving risk management policy, ensuring that the direction of operational strategies is consistent with risk management policies.

-

The Risk Management Committee, accountable to the Board, implements risk management policies and establishes the Crisis Management Group to oversee daily risk operations. The Committee reports to the Board annually on risk management performance, including strategies and actions.

-

The Crisis Management Group identifies and assesses SYSTEX’s overall risks, evaluating the impact on climate risks and the position within overall framework.

-

The Sustainability Group is responsible for identifying climate risks and opportunities every 2 years, re-evaluating relevant impacts, and formulating strategies and targets accordingly. The “Environment Team” under the Group is responsible for planning and implementing actions and then reporting to the Risk Management Committee on action performance.

Metrics and Targets

Based on climate-related assessment, SYSTEX sets phased targets and actions in 4 areas of emission management, energy management, water stewardship, and environment management. SYSTEX sets short-, medium- and long-term goals respectively and corresponding measures and actions.

- Key metrics

-

- Reduce water, electricity, waste intensity and GHG emissions.

- Maintain validity of ISO 14064-1, ISO 14001, and ISO 50001.

- Renewable energy share.

- Conduct environmental-related ISO certifications

-

- Greenhouse gas emissions

According to the guidelines of “ISO 14064-1: 2018”, SYSTEX collects and discloses emissions sources covering “Category 1, Category 2, and Category 3-6,” and has been verified by an independent 3rd-party. The boundary of GHG inventory is the headquarters building. - Environment management system and energy management system

Implement management according to the management procedures of “organizational risk and opportunity,” “environmental considerations identification,” “legislation identification,” and “energy identification and review,” and then conduct ISO verifications every year.

- Greenhouse gas emissions

- Targets and Performance

SYSTEX aims to achieve “Net Zero by 2050 at Headquarters building” and formulates its carbon reduction paths and the short-, medium-, and long-term goals accordingly, and then promotes various internal management mechanisms to move towards the ultimate goal by 2050. For more details about the SYSTEX “Targets of Net Zero Emissions and Performance,” please refer to “Environmental Sustainability Policy.”

- Regularly Conduct Assessments

Conduct climate-related risk and opportunity identification, climate scenario analysis every 2 years, and formulate corresponding strategies and measures. For more details about the SYSTEX “Environment and Energy Management Measures,” please refer to “Environment & Energy Management“.

Task Force for Nature-related Financial Disclosures, TNFD

Nature-related risks, including natural capital depletion and biodiversity loss, are increasingly seen as systemic financial risks on par with climate risks. The global community is committed to protecting biodiversity and natural capital. To comprehensively assess risks and opportunities related to nature, SYSTEX refers to the Task Force on Nature-related Financial Disclosures (TNFD) as an analysis framework.

Governance

The Chairman is the highest governance level and the CSO is the leader of the Sustainability Group to supervise ESG implementation and performance.

-

The Board has authorized the Chairman to act as the highest level of sustainability governance, establishing the “Sustainability Group,” and then set the CSO as its leader to coordinate climate and nature risk assessment and formulate strategies, goals, and measures.

-

The Group has conducted its initial nature-related assessment since 2024, with the follow-up evaluations every 2 years, thereby enhancing governance resilience.

-

The Group reports progress to the Chairman as needed, and presents annual performance results along with action plans for the following year to the Board.

Strategy

Formulate the “Environment and Energy Policy” and “Human Rights Policy,” and conduct nature-related assessment and scenario analysis.

-

The Group has conducted its initial nature-related assessment since 2024, with the scope covering SYSTEX Group and its key suppliers. The Environment Team developed response measures to address related financial impacts.

-

Timeframe for nature management: the short-term is within 2 years, the medium-term is 2-10 years, and the long-term is more than 10 years.

Assessment approach based on LEAP approach

- Assessed nature dependencies and impacts across 39 SYSTEX sites and 79 key supplier sites in Taiwan. Collected 9 types of geospatial data from the National Land Planning GIS and conducted overlay analysis within a 2 km radius of each site for biodiversity impact evaluation. The assessment identified 6 SYSTEX sites and 15 key supplier sites overlapping with biodiversity-sensitive areas. However, none overlapped with designated nature reserves, indicating no potential impact.

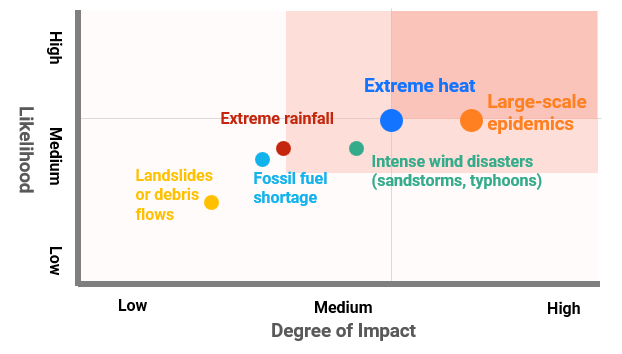

- SYSTEX collected 22 nature-related hazards for biodiversity materiality analysis. Following initial relevance screening, the Group identified 6 hazards in collaboration with external experts. Further assessment based on impact and likelihood led to 2 key hazards of “large-scale epidemics & extreme heat,” corresponding to 2 natural impacts of “disease control & local climate mitigation,” with financial impacts and management measures analyzed.

Nature-related hazard materiality matrix

Note 1: The 9 types of geospatial data from the National Land Planning GIS include “national park, nature reserve, ecological protection area, key wetland, coastal conservation zone, wildlife conservation area, critical habitats for wildlife, protected reef zone, aquatic species breeding and conservation area.”

Note 2: The 22 nature-related hazards for biodiversity include “extreme heat, declining air quality, water degradation, water scarcity, extreme rainfall, irregular rainfall, droughts, floods, eutrophication, seawater intrusion, decline in soil productivity, landslides or debris flows, intense wind disasters (sandstorms, typhoons), large-scale noise and vibration, large-scale epidemics, fossil fuel shortage, plant material shortage, animal material shortage, metal material shortage, non-metal material shortage, destruction of habitats or reduction in biological populations, reduced crop yield due to lack of plant pollination.”

Note 3: The Sustainability Group conducted the first phase of hazard identification based on the relevance to the company, reviewing 22 hazards. Through this process, 6 hazards were selected: “extreme heat, extreme rainfall, landslides or debris flows, intense wing disasters (sandstorms, typhoons), large-scale epidemics, fossil fuel shortage.”

Financial impact and mitigation measures of nature-related issues

| Nature topic | Detail | Timeframe | Impact | Likelihood | Financial impact (-) | Mitigation measure |

| Disease control | Work suspensions may disrupt operations or the supply chain, while infections may cause labor shortages and higher personnel costs. |

Mid-term | Medium-High | Medium |

|

|

| Local climate mitigation | Rising average temperatures drive up electricity use and operating costs. | Mid-term | Medium | Medium |

|

|

Risk and Impact Management

The Board is the highest governance level for risk management and has set up a “Risk Management Committee” to be responsible for supervising the effective operation of the risk management mechanism.

-

SYSTEX has set up a “Risk Management Committee” and formulated risk-related policies and procedures.

-

The Risk Management Committee, accountable to the Board, implements risk management policies and establishes the Crisis Management Group to oversee daily risk operations. The Committee reports to the Board annually on risk management performance, including strategies and actions.

-

The Crisis Management Group identifies and assesses SYSTEX’s overall risks, evaluating the impact on nature risks and the position within overall framework.

-

The Sustainability Group has conducted its initial nature-related assessment since 2024, with the scope covering SYSTEX Group and its key suppliers, formulating strategies and targets accordingly. The “Environment Team” under the Group is responsible for planning and implementing actions, thereby reporting to the Risk Management Committee on performance.

Metrics and Targets

Based on nature-related assessment, SYSTEX sets phased targets and actions.

- Key metrics

-

- Improve high-risk case care rate and statutory employee health examination rate.

- Reduce water, electricity, waste intensity and GHG emissions.

- Maintain validity of ISO 14064-1, ISO 14001, ISO 50001, and ISO 45001.

- Renewable energy share.

- Conduct ISO certifications

-

- Greenhouse gas emissions

According to the guidelines of “ISO 14064-1: 2018”, SYSTEX collects and discloses emissions sources covering “Category 1, Category 2, and Category 3-6,” and has been verified by an independent 3rd-party. The boundary of GHG inventory is the headquarters building. - OHS Management System

System procedures are implemented in accordance with internal policies, including “Risk and Opportunity Management Procedure,” “Environmental Aspect Identification Procedure,” “Regulatory Identification Procedure,” and “Hazard Identification and Management Procedure,” with annual ISO audits.

- Greenhouse gas emissions

- Targets and Performance

-

- SYSTEX aims to achieve “Net Zero by 2050 at Headquarters building” and formulates its carbon reduction paths and the short-, medium-, and long-term goals accordingly, and then promotes various internal management mechanisms to move towards the ultimate goal by 2050. For more details about the SYSTEX “Targets of Net Zero Emissions and Performance,” please refer to “Environmental Sustainability Policy.”

- STSTEX has set the nature-related goals and targets, please refer to ” Materiality Analysis, Material Topics and its Goals.”

- Regularly Conduct Assessments

Conduct nature-related dependencies, impacts, risks and opportunities assessment every 2 years, and develop response strategies. For more details about the SYSTEX “Employee Health Measures,” please refer to “Employee Health Promotion“.