According to the WEF’s “Global Risk Report 2024”, the risk of “Extreme weather events” is once again listed as the highest global risk for the next decade, with half of the top 10 risks closely related to the environment, showing the need for governments and enterprises to strengthen climate governance while implementing climate actions. For a complete assessment of climate-related risks and opportunities, SYSTEX has become a TCFD supporter since 2023, and refers to the Task Force on Climate-related Financial Disclosures (TCFD) as an analysis framework.

Task Force for Climate-Related Financial Disclosures, TCFD

Governance

The Chairman is the highest governance level for sustainable development, and assigns the CSO as the leader of the Sustainability Group to supervise ESG implementation and performance.

-

The Board has authorized the Chairman to act as the highest level of sustainability governance, establishing the “Sustainability Group” in 2020. In 2021, SYSTEX set the CSO as the leader of the Sustainability Group to supervise and coordinate climate risk assessment, formulate climate-related strategies, goals and measures.

-

The “Environment Team” under the “Sustainability Group” is responsible for identifying climate risks and opportunities, planning related strategies and goals, and implementing relevant programs.

-

In addition to integrating climate risks and opportunities into risk management, the Board holds a meeting on average every two months to discuss business strategy issues and major events of ESG, risks and opportunities.

Strategy

Formulate the “Environment and Energy Policy” and aim to achieve “Net Zero by 2050” at Headquarters Building, and implement climate risk and opportunity identification, climate scenario analysis and plan related strategies and measures.

-

The “Environment Team” under the “Sustainability Group” is responsible for identifying climate risks and opportunities, planning related strategies and goals, and implementing relevant projects, so as to address the financial impact of climate-related risks and opportunities.

-

Time horizon for climate management: the short-term is within 2 years, the medium-term is 3-5 years, and the long-term is more than 5 years.

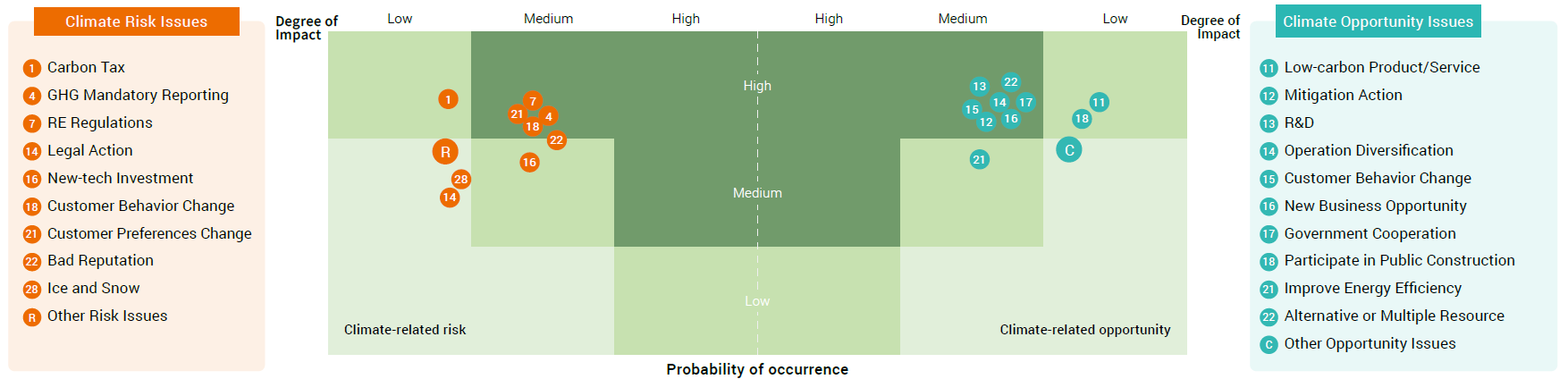

Climate-related risk and opportunity matrix

Note 1: Due to the significant overlap of 27 risk issues, they are consolidated into the “R group,” which includes 8 physical climate risk issues. With the addition of the “28-Ice and Snow” issue, there are a total of 9 physical climate risk issues within the overall 36 issues. Following the climate risk analysis, none of these are classified as material climate risk issues.

Note 2: The R group contains 27 risk issues, including “2-Energy Tax, 3-Emissions Trading, 5-Product Efficiency Regulations and Standards, 6-Product Labeling Regulations and Standards, 8-Air Pollution Controls, 9-General Environmental Regulations, 10-Uncertainty about New Regulations, 11-Lack of Regulation or Legality, 12-International Conventions or Agreements, 13-Voluntary Agreements, 15-Demand for Low-Carbon Products and Services, 17-Low-Carbon Technology Transition, 19-Uncertainty of Market Information, 20-Trigger Changes in Natural Resources, 23-Cause Negative Feedback, 24-Tropical Cyclones, 25-Extreme Temperature Changes, 26-Changes in Rainfall Patterns and Distribution, 27-Extreme Rainfall and Drought, 29-Sea Level Rise, 30-Average Temperature Change, 31-Average Rainfall Change, 32-Uncertainty of Physical Risks, 33-Changes to the Human and Cultural Environment, 34-Ebbs and Flows of Socioeconomic Conditions, 35-Humanitarian Improvement, 36-Social Uncertainty.”

Note 3: NO.24 to NO.32 risk issues are all physical risks, with a total of 9 issues.

Financial impact and management measures of climate-related major issues

SYSTEX has collected 36 Climate Risk Issues and 22 Climate Opportunity Issues, asking internal stakeholders to conduct assessment based on the degree of impact and probability of occurrence, thus identifying 7 climate risk issues and 7 climate opportunity issues to evaluate those financial impacts and formulate relevant mitigation measures. All identified climate risk issues are transition risks, covering “Market, Reputation, Policy and Legal, Technology”. The identified climate opportunity issues are covering “Products and Services, Markets, and Resilience”.

The management approach of climate-related risk and opportunity issues are listed below:

|

Type |

Issue |

Detail |

Impact |

Probability |

Financial Impact |

Mitigation Measures |

| Transitional Risks | ||||||

| Market | Customer behavior change | Due to the rising awareness of global sustainability, customers have different considerations while choosing products or services. | Medium | High |

|

|

| Reputation | Customer preferences change | Due to the rising awareness of global sustainability, customers have changed preferences for specific products or services. | ||||

| Policy and Legal | GHG mandatory reporting | Companies may be compelled to inventory, report or verify GHG emissions In line with global or domestic laws and regulations. |

|

|

||

| Renewable energy regulations | The price of renewable energy or the composition of energy sources may be affected by global or domestic laws and regulations. |

|

|

|||

| Market | Carbon tax | Tax systems related to GHG or climate change are formulated by governments. | Mid-low | High |

|

|

| Technology | New-tech investment | Companies must invest in new technologies due to climate change. Wrong positioning or investment targets as well as tech-bottlenecks can cause losses. | Mid-low | Mid-high |

|

|

| Reputation | Bad reputation | Due to the rising awareness of global sustainability, products or services that have negative impacts can create bad reputation.。 |

|

|

||

| Opportunity | ||||||

| Products and Services | R&D | Adopting innovative processes or changing services can contribute to the mitigation and adaptation of climate change. | Medium | High |

|

|

| Customer behavior change | Customers have different considerations while choosing products or services. |

|

|

|||

| Operation diversification | Provide more low-carbon products or services to stabilize market position and competitiveness. |

|

|

|||

| Mitigation action | New products or services help to reduce or adapt to the impact of global climate change risks. |

|

|

|||

| Markets | New business opportunity | Increase profits in existing markets, or find new business opportunities in emerging markets. |

|

|

||

| Government cooperation | Participate in government projects related climate change to obtain subsidies or rewards, and to gain popularity for products or services. |

|

|

|||

| Resilience | Alternative or multiple resource | Improve supply chain reliability and operational capabilities under a wide range of conditions. |

|

|

||

Climate-related Scenarios

Analyze the financial impact of electricity consumption through 2 climate-related scenarios of “IEA NZE 2050” and “RCP8.5”, and analyze the carbon tax costs in 2025-2050 through 3 scenarios.

- [IEA NZE 2050]

According to the “2050 Net Zero Emission scenario” of the International Energy Agency, the global warming will be controlled with 1.5°C, and the energy transition will be promoted by replacing fossil fuels with low-emission electricity. It is expected that the carbon price will double in 2050 compared to 2030, and energy intensity will be reduced by 1% per year. Therefore, with an estimated 20% reduction in electricity consumption and a doubling of energy costs, the electricity costs are expected to increase by 60%. - [RCP8.5]

According to the RCP8.5 scenario, it is estimated that the global mean temperature will increase by about 1.62°C in 2030, which is expected to increase electricity consumption by 9.7%. Therefore, in the case of a 25% increase in electricity prices in 2030, the electricity costs are expected to increase by 37%. Meanwhile, it is estimated that the global mean temperature will increase by about 2.59°C in 2050, which is expected to increase electricity consumption by 15.5%. Therefore, in the case of a 100% increase in electricity prices in 2030, the electricity costs are expected to increase by 131%. - [Carbon Tax]

Referring to the scenario parameters released by NGFS, SYSTEX has selected carbon pricing in 3 different scenarios of “high-, medium- and low-emissions”, with the carbon tax of US$2.63, US$231.86, and US$268.13 per tCO2 respectively, to estimate the future carbon emission growth and related financial impact. The analysis results show that the low-emissions scenario is expected to increase the cumulative carbon tax cost of NT$464 million, which will cause the greatest financial impact.

Risk Management

The Board of Director is the highest governance level for risk management, and has set up a “Risk Management Committee” under the Board to be responsible for supervise the effective operation of the risk management mechanism.

-

SYSTEX has set up a “Risk Management Committee” in 2022 and formulated “Risk Management Best Practice Principles,” “Risk Management Policies and Procedures” and relevant regulations, management documents and measures. It is clearly stipulated that the Board of Directors is responsible for approving risk management policy, procedures and management structures, ensuring that the direction of operational strategies is consistent with risk management policies, establishing an appropriate risk management mechanism, and supervising the effective operation of the risk management mechanism.

-

The Risk Management Committee is accountable to the Board. It not only fully implements risk management policy, but also sets up the “Crisis Management Group” to be responsible for promoting risk related affairs, ensuring that the risk management mechanism is implemented in daily operations. The Risk Management Committee reports to the Board at least once a year on risk-related management performance including strategies, targets, and actions. Besides, the Crisis Management Group is responsible for cross-departmental coordination and risk awareness training.

-

The Crisis Management Group is responsible for the identification and assessment of SYSTEX’s overall risks, evaluating the impact of various issues from the perspective of the overall business operation to determine the impact of climate-related risks relative to SYSTEX’ various risks.

-

The Sustainability Group is responsible for identifying climate risks and opportunities, re-evaluating relevant impacts and planning strategies, targets and actions every year. The “Environment Team” under the “Sustainability Group” is responsible for planning and implementing actions and then reporting to the Risk Management Committee on action performance.

Metrics and Targets

4 pillars of actions: emission management, energy management, water stewardship, and environment management. SYSTEX sets short-, medium- and long-term goals respectively and corresponding measures and actions.

- Key metrics

-

- Resource conservation and waste reduction: reduction of water consumption per revenue, reduction of electricity consumption per revenue, reduction of total waste per revenue, GHG emission reduction.

- Continuously conduct ISO verifications.

- Renewable energy consumption rate.

- Conduct environmental-related ISO verifications

-

- Greenhouse gas emissions

According to the guidelines of “ISO 14064-1: 2018”, SYSTEX collects and discloses emissions sources covering “Direct GHG Emissions (Category 1)”, “Indirect GHG Emissions from Imported Energy (Category 2)”, and “Other Indirect GHG Emissions (Category 3-6)”, and has been verified by an independent 3-party. The boundary of GHG inventory is the headquarters building. - Environment management system and energy management system

Implement management system operating procedures in accordance with the management procedures of “organizational risk and opportunity”, “environmental considerations identification”, “legislation identification”, and “energy identification and review”, and then conduct ISO verifications every year.

- Greenhouse gas emissions

- Metrics and targets

SYSTEX aims to achieve “Net Zero by 2050 at Headquarters building” and formulates its carbon reduction paths and the short-, medium-, and long-term goals accordingly, and then promotes various internal management mechanisms to move towards the ultimate goal by 2050. For more details about the SYSTEX “Targets of Net Zero Emissions and Performance”, please refer to “Environmental Sustainability Policy“. - Conduct climate-related risk and opportunity identification, climate scenario analysis and formulate corresponding strategies and measures. For more details about the SYSTEX “Environment and Energy Management Measures”, please refer to “Environment & Energy Management“.