- Sustainable Development

- Letter from the Chairman

- Sustainable Highlights

- Sustainable Operation

- Corporate Governance

Risk Management

In view of the global trend of emphasis on risk management, SYSTEX has improved the risk management mechanism to reduce the impact of risks, improve operational efficiency and corporate resilience in response to risks, and increase competitive advantages to implement sustainable operations. In 2022, SYSTEX has established a cross-divisional Risk Management Committee under the Board of Directors, and formulated “Risk Management Best Practice Principles“, “Risk Management Policies and Procedures“, “Rules of Risk Management”, “Rules of Strategic Investment Management” and “Rules of Supervision and Management of Subsidiaries” to effectively control risks and improve management efficiency.

Risk Management Policy and Principle

|

Risk Management Goal

|

The SYSTEX Risk Management goals aim to consider and manage various risks that may affect the achievement of corporate goals through a complete risk management structure, and to achieve the following goals by integrating risk management into operational activities and daily management processes:

|

|

Risk Management Principle

|

|

Risk Management Organization

SYSTEX strengthens risk management with the Board of Directors as the highest governing body. A Risk Management Committee is established under the Board’s supervision to integrate risk management and supervision into daily activities and achieve sustainable operations.

Risk Management Organizational Structure

Board of Directors

As the highest governance unit for risk management of SYSTEX Group, the responsibilities of the board of directors are:

- Approve the “Risk Management Policies and Procedures” and risk management structures.

- Ensure that the operational strategic direction is consistent with risk management policies.

- Ensure that risk management mechanisms and risk management culture have been established.

- Supervise and ensure the effective operation of the overall risk management mechanism.

- Allocate and assign sufficient and appropriate resources to enable risk management to operate effectively.

Risk Management Committee

The Risk Management Committee executes risk management policies and reviews them periodically, and is accountable to the Board. They determine risk tolerance, prioritize risk management, and report on progress to the Board at least once a year or submit proposals for Board approval. Risk management matters and the 2024 implementation status were reported to the Board on December 17, 2024.

Crisis Management Group

The Crisis Management Group develops risk policies, procedures, and frameworks. They establish risk metrics and tolerance levels, analyze company risks, and oversee and coordinate risk management activities across departments. The Crisis Management Group is responsible for enhancing risk awareness among the entire organization with training programs. The Group is consisted of a number of functional division head of “Financial Division, Business Management Division, Legal Division, HR Division, Data & Info. R&D Division and BU/BI”. As a result, the Crisis Management Group held a meeting quarterly, with a total of 4 meetings in 2024.

Crisis Response Team

The Crisis Management Group has set up the Crisis Response Teams, grouping by crisis events. These teams are immediately activated when a crisis may occur, and are responsible for identifying the main causes of the crisis and dealing with the situation according to the “Rules of Risk Management.”

| Team | Person in Charge | Leader | Responsibility |

| Regulatory Compliance | Legal Division head or his assignee | Legal Division head |

|

| Biz. Continuity | Business Identity head or his assignee | Business Identity head |

|

| Disaster Response | Human Capital Center head or his assignee | Human Capital Center head |

|

| Information Security Protection | Information Security Technology Department head | Data & Info. R&D Division head |

|

| Social Media | Marketing & PR Division head or his assignee | Marketing & PR Division head |

|

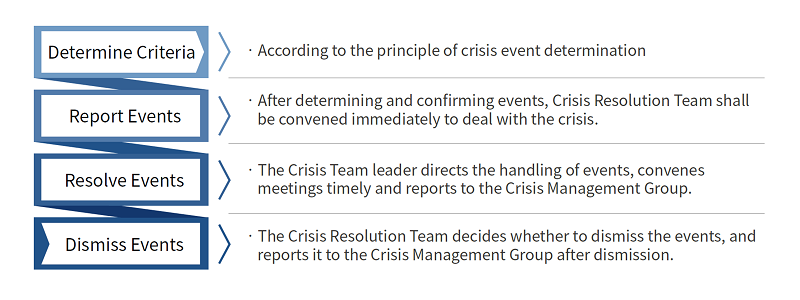

Crisis Management Procedures

Risk Trends and Material Issues

According to the development trends outlined in the Global Risk Report 2025 published by the World Economic Forum, five of the top ten long-term global risks are environmental in nature. These include: extreme weather events, biodiversity loss and ecosystem collapse, major disruptions to Earth systems, natural resource shortages, and pollution. Recognizing that employees are the core competitive strength of SYSTEX, the company places significant emphasis on risk issues closely related to its workforce. Accordingly, SYSTEX has developed targeted mitigation measures and management strategies for the following risk categories: “climate and nature risks,” “information security risks,” “human rights risks” and “health risks”.

For more details on these risks, please click the following links: